How to register for GST in Australia?

You can easily register for GST in Australia online via Business Portal. However it's quite challenging to find where to do this. So here's the GST registration guide with pictures.

How to register for GST on Business Portal?

If you have ABN already:

- Login to ATO Business Portal.

- Go to Business Registration details in the menu.

- Select the registrations radio button, then select next.

- Select add tax type.

- Select the tax type to be added (GST in this instance), then select next.

- Enter the details as prompted.

And below all these steps detailed with the pictures:

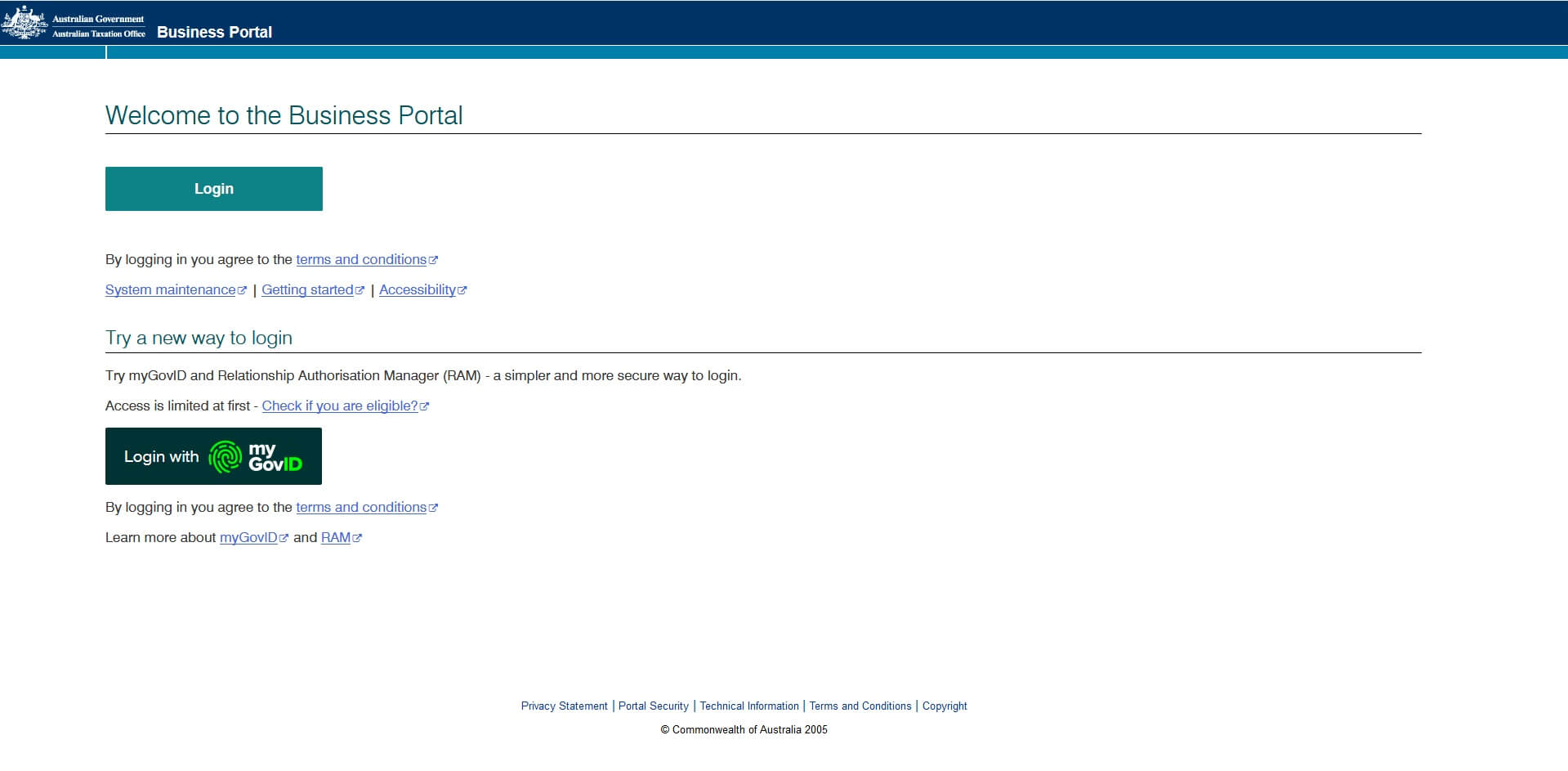

Step 1: Login to ATO Business Portal.

Currently you can access the Business Portal using your AUSkey or Manage ABN Connections. However myGovID and Relationship Authorisation Manager (RAM) will replace AUSkey and Manage ABN Connections in March 2020.

Manage ABN Connections allows you to access government online business services using your myGov login. It's a secure and more convenient login alternative to an AUSkey that can be used from any smart device.

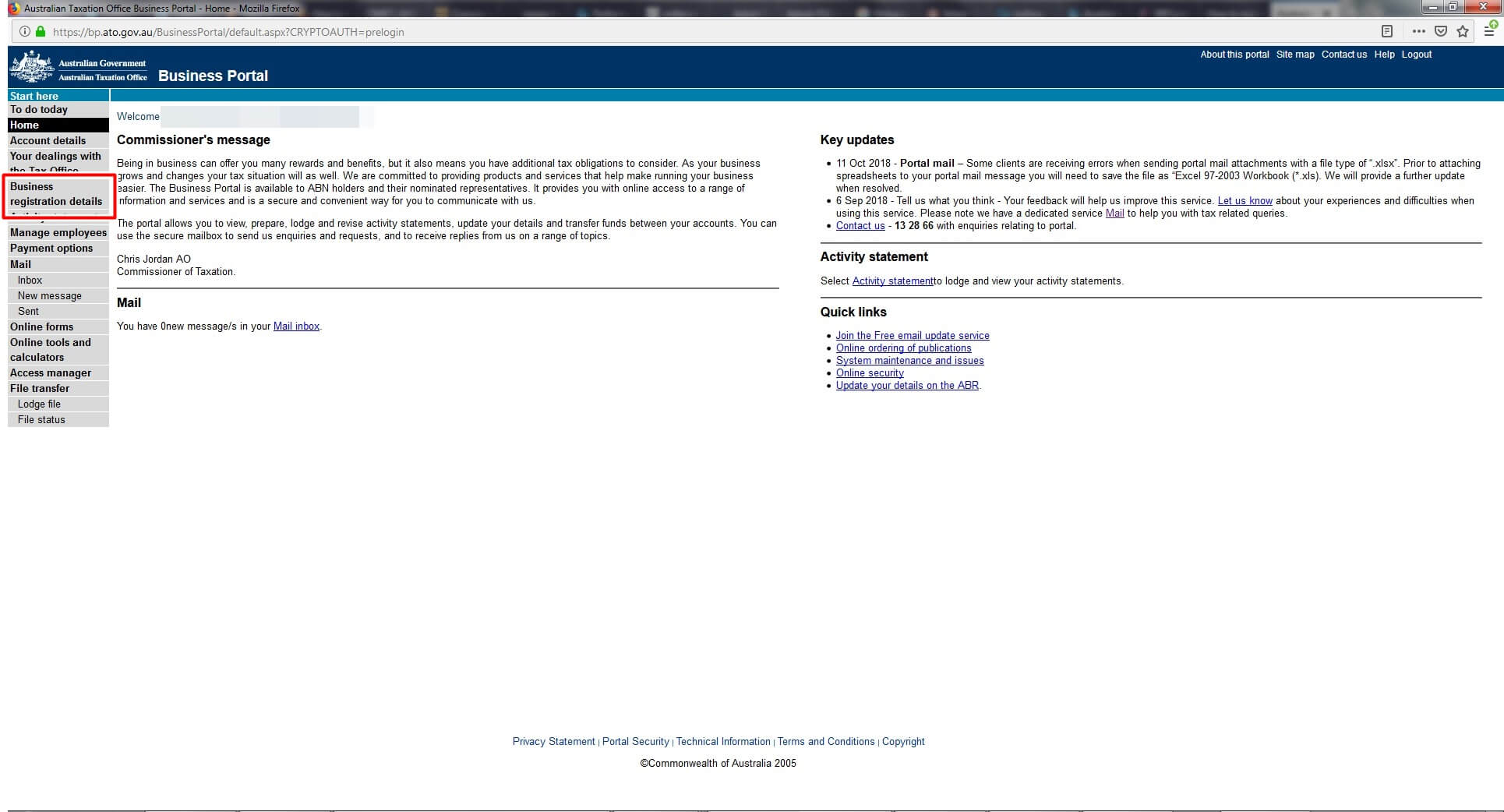

Step 2: Go to Business Registration details in the menu.

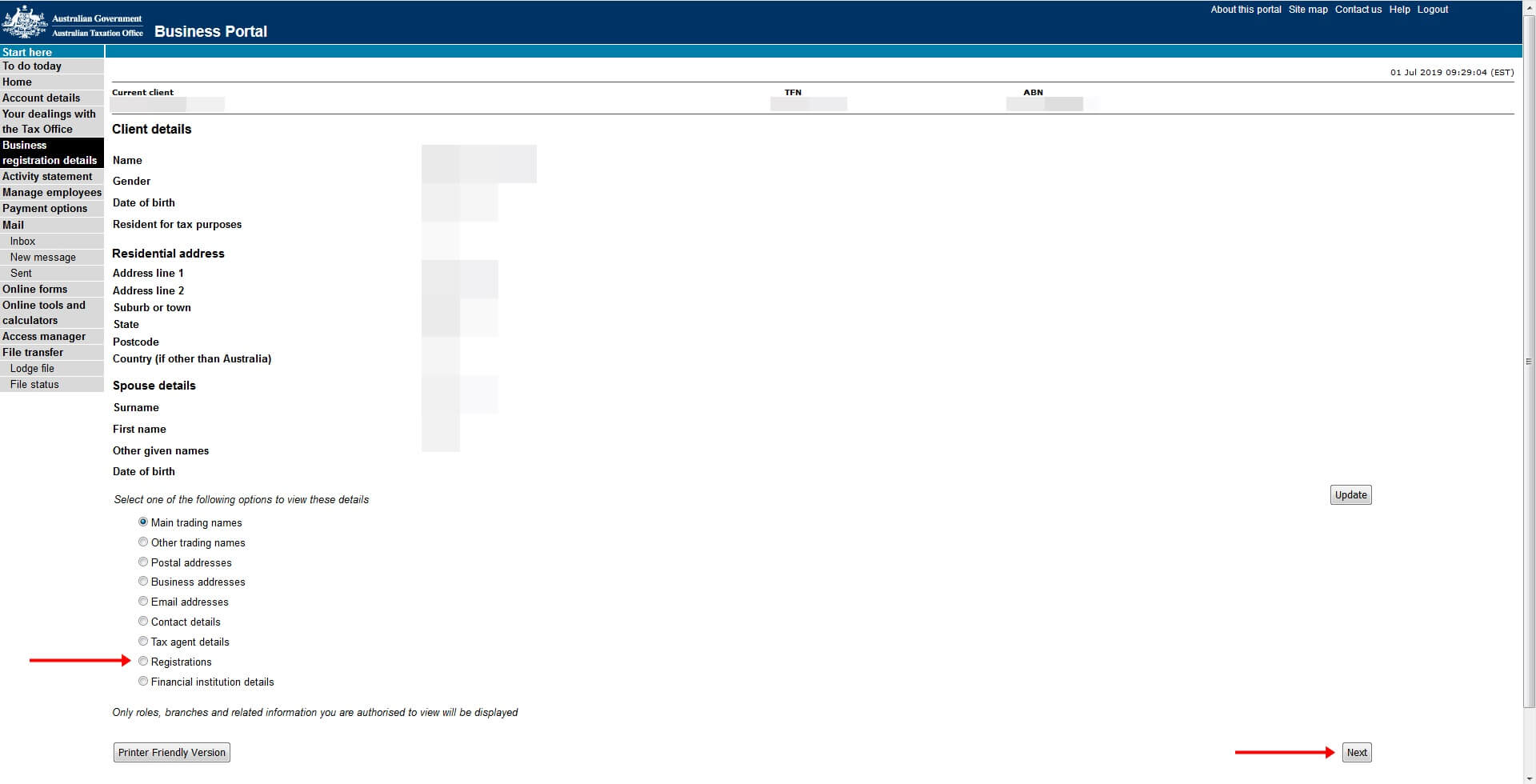

Step 3: Select the registrations radio button, then select next.

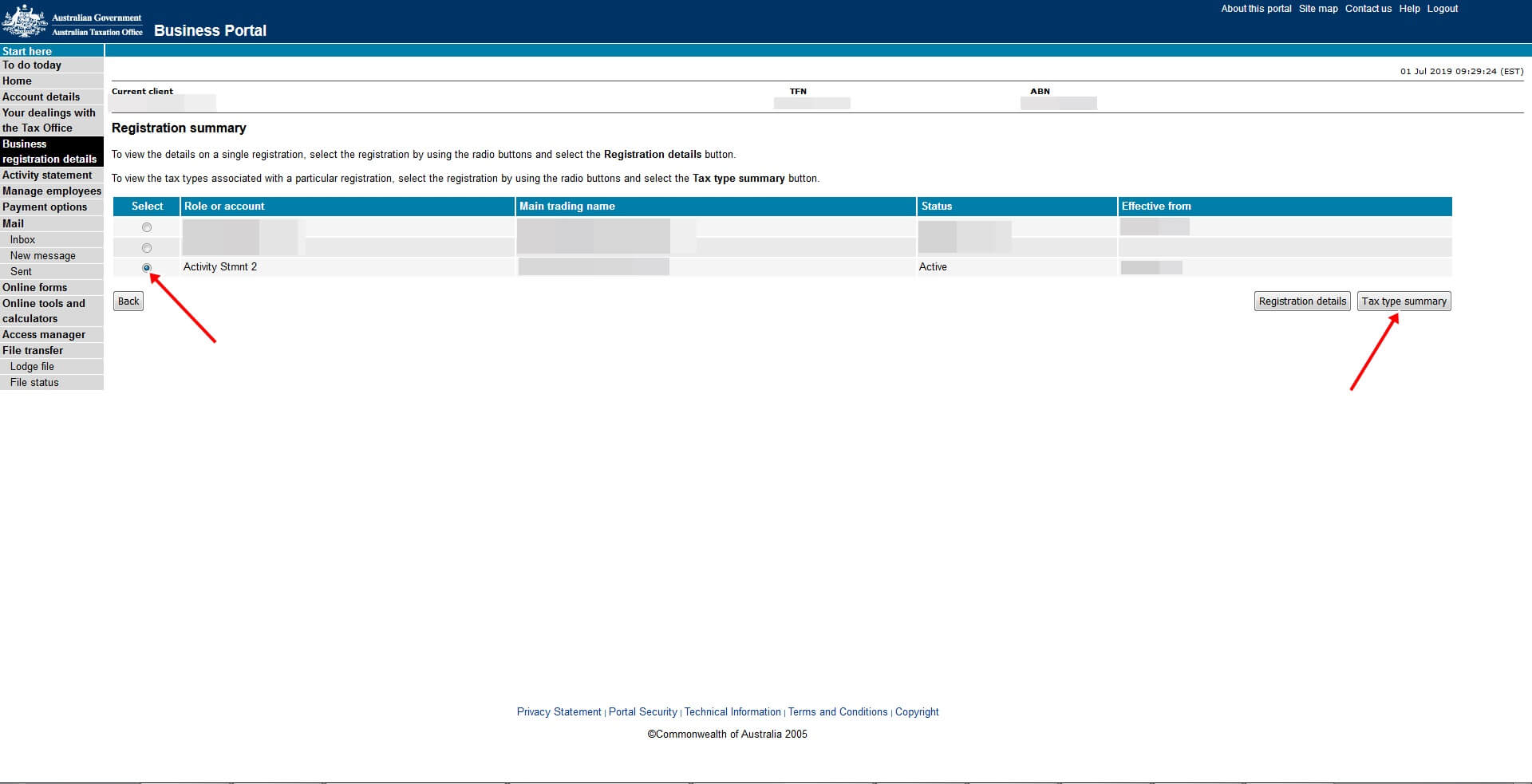

Step 4: Select "Activity Stmnt" and select "Add tax type".

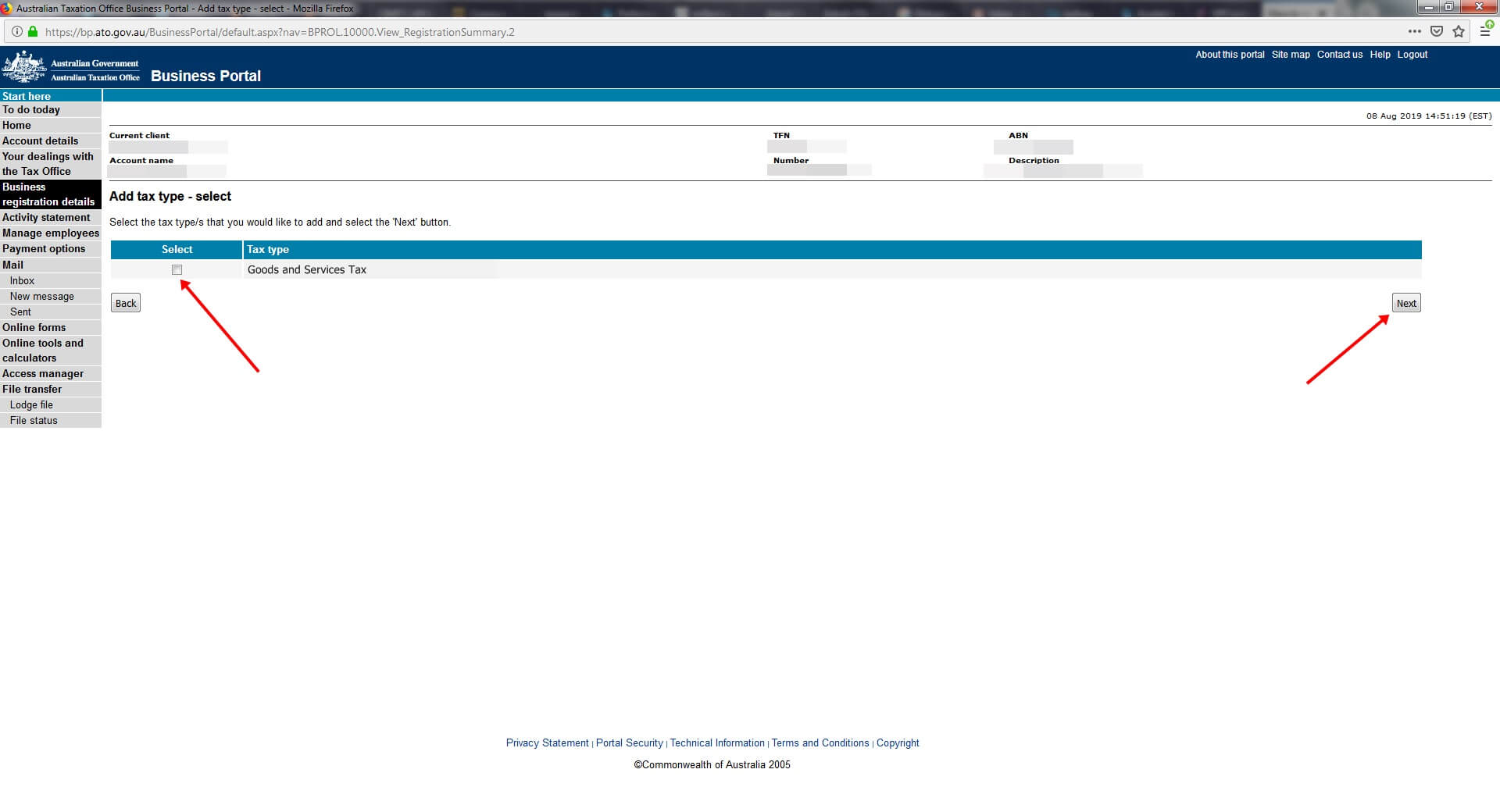

Step 5: Select the tax type to be added (GST in this instance), then select next

Step 6: Enter the details as prompted. That's it!

GST FAQ

Should I register for GST?

It's mandatory to register for GST if you expect your annual turnover to be $75,000 or more. If your turnover will be less than this, registering for GST is optional. However when your turnover reach $75,000 you need to register for GST withing 21 days.

How do I register for GST as a sole trader?

If you are sole trader and have an ABN you can register for GST through your accountant or through ATO Business Portal online. Please use our step-by-step guide on this page if you want to do this yourself via Business Portal.

How much does it cost to register for GST?

Registering for GST is free in Australia. However some companies charge $70+ for this GST registration and asking the same information you would enter yourself on the ATO Business Portal. Don't fall for this trap and use our guide instead.

Can I charge GST if not registered?

Anyone not registered for GST can not charge GST on any invoices issued to customers/clients. They also can not claim back the GST they pay on any invoices (but can claim the total business expense instead). Your invoice also must not say Tax Invoice and just say Invoice if you are not registered for GST.

Don't forget to try our GST Calculator when you are doing your next BAS lodgement.